意见:1 创始人: Site Editor Publish Time: 2025-04-25 Origin: 网站

The GPU, or graphics processing unit, is a

secondary processor designed to perform graphics and graphics computing tasks

in a wide range of applications, from PCs to workstations and many mobile

devices. In China, the development of the GPU industry shows a trend of

domestic manufacturers gradually emerging and continuous technological

innovation, however, compared with international leaders, there is still a

certain gap.

First, the industrial chain

The upstream of the GPU industry chain covers the supply of materials and equipment, including silicon wafers, photoresists, sputtering targets, electronic special gases and packaging materials. In terms of equipment, it includes lithography machines, etching machines and thin film deposition equipment. The midstream segment focuses on the R&D and production of GPU chips, which can be divided into different types such as PC GPU, server GPU and mobile GPU according to application scenarios. The downstream market is widely used in many fields such as data centers, artificial intelligence, cloud computing, and the Internet of Things.

2. Upstream analysis

1. Silicon wafers

(1) Market size

Although many core semiconductor wafer

companies have launched capacity expansion plans, in the long run, it is

expected that their production capacity will still be insufficient to fully

meet the growing demand for semiconductor silicon wafers in the chip

manufacturing field. Coupled with the consideration of medium and long-term

supply security, China's semiconductor wafer industry will continue to maintain

a rapid development trend. According to the "2025-2030 Global and Chinese

Semiconductor Wafer Industry Development Trend Analysis and Investment Risk

Prediction Report" released by the China Business Industry Research

Institute, from 2019 to 2023, China's semiconductor wafer market size climbed

from 7.710 billion yuan to 12.330 billion yuan, with an average annual compound

growth rate of 12.45%. Analysts at the institute further predict that in 2024,

China's semiconductor wafer market is expected to reach 13.1 billion yuan.

<!--[if gte vml 1]>

Source: China Business Research Institute

(2) Analysis of key enterprises

Compared with the major international

semiconductor wafer suppliers, China's mainland semiconductor wafer

manufacturers are still insufficient in terms of market share, and there is a

significant gap between their technical process level and yield control ability

and the international leading level. Among the leading enterprises in the field

of semiconductor silicon wafers in China, Shanghai Silicon Industry, Lion

Micro, TCL Zhonghuan and Zhongjing Technology have all shown their respective

production capacity and business layout, and the specific details can be seen

in the following chart:

<!--[if gte vml 1]>

Source: China Business Industry Research

Institute

2. Photoresist

(1) Market size

At present, the global photoresist market

has expanded to a scale of 10 billion US dollars, showing huge market

potential. China's photoresist industry chain is gradually improving, and with

the continuous expansion of downstream demand, the photoresist market scale is

also showing a significant growth trend. According to the "2025-2030

Global and China Photoresist and Photoresist Auxiliary Materials Industry

Development Status Research and Investment Prospect Analysis Report"

released by the China Commercial Industry Research Institute, the scale of

China's photoresist market is expected to reach about 10.92 billion yuan in

2023, and this figure is expected to further increase to 11.44 billion yuan in

2024. Analysts at the China Business Industry Research Institute predict that

by 2025, the scale of China's photoresist market is expected to climb to 12.3

billion yuan.

<!--[if gte vml 1]>

Source: China Business Research Institute

(2) Analysis of key enterprises

The main application areas of photoresist

cover the semiconductor, panel and PCB industries. Further market segments,

especially in the field of semiconductor photoresists, have extremely high

technical requirements, and the market is mainly dominated by internationally

renowned companies such as JSR, Tokyo Oika, Shin-Etsu, DuPont, and Fuji. The

specific distribution is shown in the figure.

<!--[if gte vml 1]>

Source: China Business Research Institute

3. Electronic special gas

(1) Market size

China's electronic specialty gas market has

also shown a sustained and steady upward trend. According to the

"2025-2030 Global and China Electronic Special Gas Industry Prospect and

Market Trend Insight Special Research Report" released by the China

Commercial Industry Research Institute, the scale of China's electronic special

gas market has reached 24.9 billion yuan in 2023 and is expected to increase to

about 26.25 billion yuan in 2024. Analysts at the China Business Industry

Research Institute predict that with the rapid development of semiconductor

industries such as integrated circuits and display panels, the demand for

electronic special gases will continue to rise, and it is expected that by

2025, the market size of China's electronic special gases will exceed 27.9

billion yuan.

<!--[if gte vml 1]>

Source: China Business Industry Research

Institute

(2) Competitive landscape

At present, in China's electronic special

gas market, foreign companies occupy a dominant position. Among them, the air

chemical industry has the largest market share, accounting for 25% of the

share. It is followed by Germany's Linde Group, Air Liquide and Sun Nippon

Sanso, with market shares of 23%, 22% and 16%, respectively.

<!--[if gte vml 1]>

Source: China Business Research Institute

4. Encapsulation material

(1) Encapsulation substrate

There are significant differences between

packaging substrate products and conventional PCB products, and their

processing difficulty is high and the investment threshold is strict, which

constitutes the two main thresholds for the development of the industry. In recent

years, with the in-depth promotion of domestic substitution strategies, China's

packaging substrate industry has ushered in new opportunities for development.

According to the "2025-2030 China Semiconductor Packaging Substrate

Industry Market Analysis and Prospect Trend Research Report" released by

the China Business Industry Research Institute, the size of China's packaging

substrate market will reach about 20.7 billion yuan in 2023, an increase of

2.99% over the same period of the previous year. Analysts at the institute

predict that the market size will further expand to 21.3 billion yuan in 2024,

and by 2025, the market size is expected to climb to 22 billion yuan.

<!--[if gte vml 1]>

Source: China Business Industry Research

Institute

The functions of the package substrate to

the chip cover power supply connection, protection, support, heat dissipation,

and assembly, etc., aiming to achieve the goals of increasing the number of

pins, reducing the size of the packaged product, improving electrical

performance and heat dissipation performance, and achieving ultra-high-density

integration or multi-chip modularization. The situation of key enterprises is

shown in the figure.

<!--[if gte vml 1]>

Data source: Compiled by Prismark and China

Business Industry Research Institute

(2) Bonding wire

Bonding wire, as a tiny metal wire that

realizes the electrical connection between the input and output connection

points of the internal circuit of the chip and the internal contact points of

the lead frame, its diameter is between a dozen microns and tens of microns.

According to different materials, bonding wires can be divided into two

categories: non-alloy wires and alloy wires. Non-alloy wires mainly include

gold wire, silver wire, copper wire and aluminum wire; The alloy wire covers

varieties such as gold-plated silver wire and copper-plated bonding wire.

China's leading enterprises in the field of

bonding wires, such as Heraeus, Japan's Tanaka Precious Metals Group, Yantai

Yinuo Electronic Materials Co., Ltd., etc., all occupy an important position in

the market. For a list of companies, please refer to the diagram below.

<!--[if gte vml 1]>

Source: China Business Industry Research

Institute

(3) Lead frame

At present, most of the world's leading

lead frame manufacturers are concentrated in Asia, and some of them have a

significant share of the international market. Although the Dutch Société

Electronics Group is located in Europe, other major companies are located in

Asia. In Chinese mainland, companies such as Ningbo Kangqiang Electronics Co.,

Ltd. and Ningbo Hualong Electronics Co., Ltd. have also emerged that have

achieved outstanding results in the field of lead frame manufacturing, please

refer to the chart below for details.

<!--[if gte vml 1]>

Source: China Business Industry Research

Institute

5. Etching machine

(1) Market size

Etching machines, as key equipment for the

manufacture of semiconductor devices, photovoltaic cells and various types of

micromachinery, have shown significant market growth momentum in the world in

recent years. According to the "2025-2030 Global and China Semiconductor

Equipment Industry In-depth Research Report" released by the China

Business Industry Research Institute, the total global etching machine market

will reach about US$14.82 billion in 2023, an increase of 5.93% over the same

period last year, and the market size is expected to further expand to US$15.65

billion in 2024. Analysts at the institute predict that the global etching

machine market is expected to reach $16.48 billion by 2025.

<!--[if gte vml 1]>

Source: Gartner and China Business Industry

Research Institute

(2) Analysis of key enterprises

Competition in the field of etching

machines is extremely concentrated and intense. On the global stage,

international giants such as LAMResearch, AMAT and TEL have firmly controlled

the market with their cutting-edge technology, diversified product portfolio

and large customer network, accounting for the majority of the etching machine

market. At the same time, domestic enterprises such as China Micro Corporation

and North Huachuang have gradually emerged in the field of etching machines by

relying on independent research and development and innovation strength, and

have become leaders in the domestic industry. For details, please refer to the

chart.

<!--[if gte vml 1]>

Source: China Business Research Institute

3. Midstream analysis

Global GPU market size

With the rapid development of artificial

intelligence and supercomputing technology, the market demand for GPUs, as the

core components of these key technologies, is rising. According to the

"2025-2030 China GPU Industry Market Status Survey and Development Trend

Forecast Research Report" released by the China Business Industry Research

Institute, the global GPU market size has reached about $59.5 billion in 2023

and is expected to increase to about $71.9 billion in 2024. Analysts at the

China Business Industry Research Institute predict that the global GPU market

will continue to expand and is expected to exceed the $80 billion mark by 2025.

<!--[if gte vml 1]>

Source: China Business Research Institute

Chinese GPU market

As a general-purpose AI chip, GPUs have

demonstrated excellent performance in the field of parallel computing,

especially for those application scenarios that require large parallel

computing, such as machine learning and deep learning. In recent years, China's

GPU market is ushering in a new stage of rapid development. According to the

"2025-2030 China GPU Industry Market Status Survey and Development Trend

Forecast Research Report" released by the China Business Industry Research

Institute, in 2023, the scale of China's GPU market will reach 80.7 billion

yuan, a year-on-year increase of 32.78%, and it is expected to exceed 107.3

billion yuan in 2024. Analysts at the China Business Industry Research

Institute predict that by 2025, the size of China's GPU market is expected to

increase to 120 billion yuan.

<!--[if gte vml 1]>

Source: China Business Research Institute

3. GPU Competitive Landscape

The overall value of discrete GPUs in

discrete graphics cards has increased significantly. With the growing demand

from high-end software office users, gamers and e-sports enthusiasts, the

market share of discrete GPUs has also continued to rise. In the field of

discrete CPUs, Nvidia occupies the absolute leading position, with a market

share of about 81%, while AMD's market share is about 19%.

<!--[if gte vml 1]>

Source: JPR, China Business Industry

Research Institute

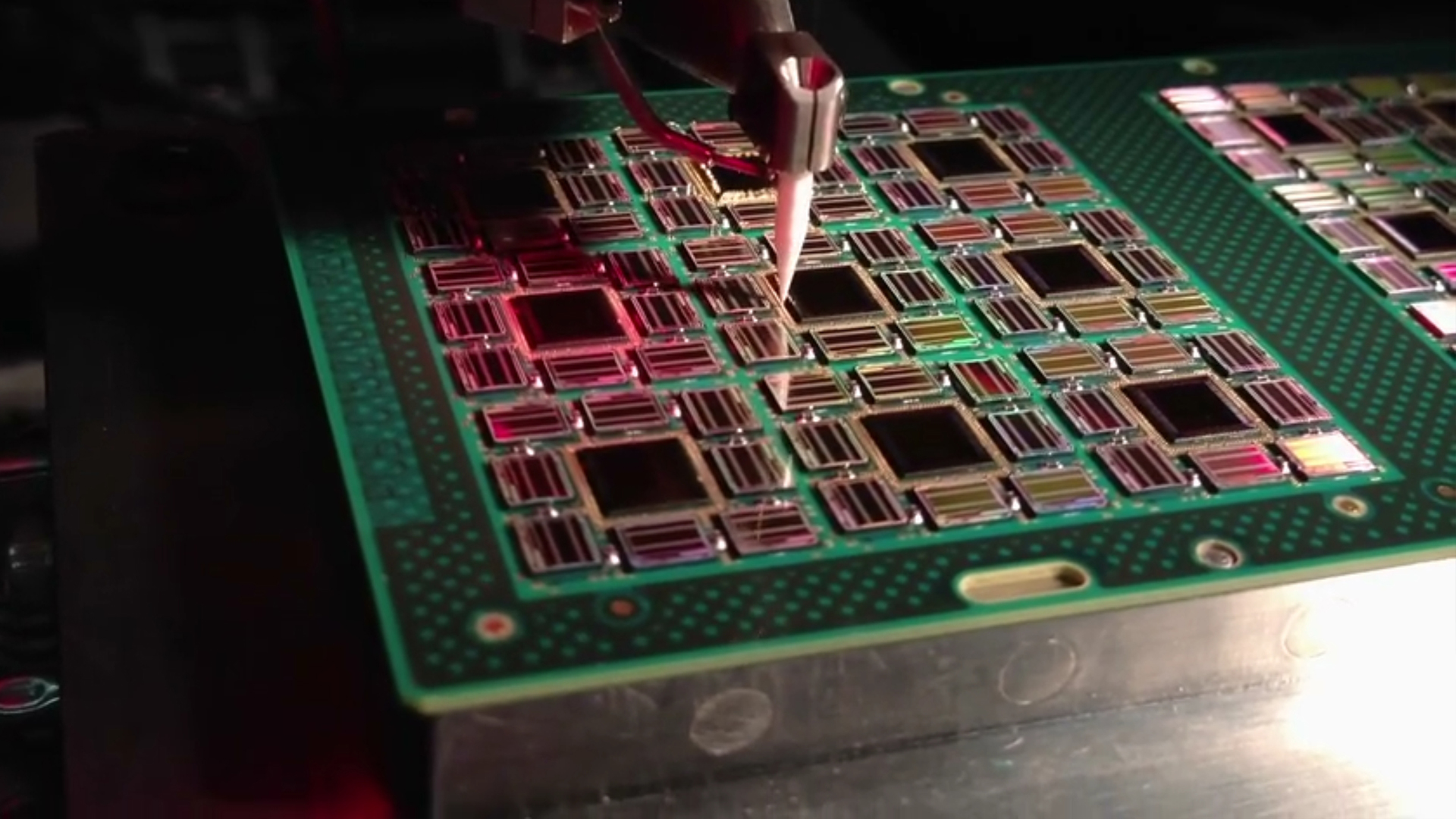

4. GPU enterprise layout

<!--[if gte vml 1]>

Source: China Business Industry Research

Institute

5. Analysis of key enterprises

At present, the A-share listed companies

focusing on the GPU field are mainly concentrated in Guangdong Province, with a

total of 14. Beijing and Jiangsu Province both have 8 listed companies, ranking

second.

<!--[if gte vml 1]>

Organized by China Business Industry

Research Institute

Fourth, downstream analysis

1. Data centers

According to the data released by the

Ministry of Industry and Information Technology, China's three basic telecom

operators continue to improve the layout planning of computing infrastructure.

By the end of 2024, the number of Internet data center racks open to the public

has reached 830,000, which effectively promotes the collaborative operation of

computing power and network, improves scheduling efficiency, and facilitates

the provision of diversified computing services.

<!--[if gte vml 1]>

Source: Ministry of Industry and

Information Technology, China Business Research Institute

2.AI computing power

In 2024, China's total intelligent

computing power will achieve a breakthrough of 725.3 trillion times per second

(EFLOPS), an increase of 74.1% over the same period of the previous year, which

is more than three times the growth rate of general computing power (20.6%) in

the same period. According to the prediction of analysts at the China Business

Industry Research Institute, in 2025, the scale of China's intelligent

computing power is expected to jump to 1037.3EFLOPS.

<!--[if gte vml 1]>

Data source: IDC, China Business Research

Institute

3. Cloud computing

China's cloud computing market continues to

show strong vitality and vitality. According to the "2025-2030 China Cloud

Computing Industry In-depth Analysis and Development Trend Forecast Research

Report" released by the China Business Industry Research Institute, in

2023, the scale of China's cloud computing market has exceeded 616.5 billion

yuan, a year-on-year surge of 35.5%, which far exceeds the global average and

is expected to reach about 837.8 billion yuan in 2024. Analysts at the China

Business Industry Research Institute predict that with the promotion of AI

native technology and the innovation of cloud computing technology, as well as

the gradual implementation of large-scale models, China's cloud computing

industry will enter a new growth peak. It is estimated that by 2027, the scale

of China's cloud computing market will grow by leaps and bounds, and is

expected to exceed 2.1 trillion yuan.