Tampilan:1 创始人: Site Editor Publish Time: 2026-01-21 Origin: Site

Panoramic analysis of China's GPU

industry chain in 2025

GPUs, or graphics processing units, have

long gone beyond the traditional definition of "graphics

accelerators" as the core components of processing image and graphics

computing tasks. From high-definition image rendering on personal computers, to

complex data visualization on workstations, to smooth interactive experiences

on mobile devices such as smartphones and tablets, its application scenarios

have penetrated into all aspects of digital life. In our country, the GPU

industry is undergoing a transformation stage from technology to gradual

independent innovation, and domestic manufacturers have emerged with policy

support and R&D investment, but compared with international leaders such as

NVIDIA and AMD, there is still a significant gap in high-end chip performance,

ecosystem construction, etc.

1. Panorama of the industrial chain: a

complete link from basic materials to terminal applications

The GPU industry chain is like a

precision-meshed gear belt, and the upstream is the "cornerstone

layer" that supports chip manufacturing, covering the two core sectors of

materials and equipment. The midstream is the "core layer" that

determines the technical level, focusing on the R&D, design, and

manufacturing of GPU chips. the downstream is the "application layer"

that releases industrial value, widely radiating cutting-edge fields such as

data centers and artificial intelligence.

Upstream link: materials include key raw materials such as silicon wafers,photoresists, sputtering targets, electronic special gases and packaging

materials, the purity and performance of these materials directly determine the

basic quality of the chip; In terms of equipment, it is represented by

lithography machines, etching machines, and thin film deposition equipment,

which are the guarantee of accuracy and efficiency in the chip manufacturing

process.

Midstream link: According to the difference in application scenarios, GPU chips

can be subdivided into PC GPUs for personal computers, server GPUs serving data

centers, and mobile GPUs adapted to mobile terminals.

Downstream link: With the vigorous development of the digital economy, the

application boundaries of GPUs continue to expand, extending from traditional

graphics processing to diversified fields such as data center computing power

support, artificial intelligence model training, cloud computing resource

scheduling, and intelligent interaction of Internet of Things devices, becoming

the "computing power engine" of digital infrastructure.

2. Upstream analysis: the "road to

breakthrough" of materials and equipment

1. Silicon wafers: the

"cornerstone" of chip manufacturing

(1) Market size: continuous expansion

driven by demand

Although the world's core semiconductor

silicon wafer companies have launched capacity expansion plans, the long-term

supply and demand imbalance pattern has not changed in the context of the rapid

growth of the chip industry. In particular, driven by our country's independent

and controllable strategy of semiconductors, silicon wafers, as the core

material of chip manufacturing, have shown explosive growth in market demand.

According to data from the China Business Industry Research Institute, from 2019

to 2023, our country's semiconductor silicon wafer market size has steadily

climbed from 7.710 billion yuan to 12.330 billion yuan, with an average annual

compound growth rate of 12.45%, which far exceeds the global average. Looking

ahead, analysts predict that the market size will further increase to 13.1

billion yuan in 2024, and the growth momentum of the silicon wafer market will

be more abundant as domestic fab production capacity continues to be released.

(2) Enterprise pattern: local forces in

catching up

Compared with international giants such as Shin-Etsu Chemical and SUMCO, there is still a gap in market share and technology maturity among our country's mainland silicon wafer companies, especially in the field of 12-inch large-size silicon wafers, and the yield rate control ability needs to be improved. However, local companies such as Shanghai Silicon Industry, Leon Micro, TCL Zhonghuan, and Zhongjing Technology have gained a firm foothold in the 8-inch and below silicon wafer market and are accelerating their breakthrough to the large-size field. For example, through years of technology accumulation, the Shanghai silicon industry has achieved batch supply of 12-inch silicon wafers, breaking the long-term monopoly of foreign enterprises; Leon Micro relies on its vertical integration advantages to form synergies in the field of silicon materials and device manufacturing, and these companies together constitute the "main force" of our country's silicon wafer industry.

2. Photoresist: The "precision

brush" of chip manufacturing

(1) Market size: technological

breakthroughs drive growth

As the core material of the

photolithography process, the quality of photoresist directly affects the

process accuracy of the chip. The global photoresist market has reached 10

billion US dollars, and although our country market started late, it has shown

a rapid growth trend with the acceleration of the localization process of the

semiconductor industry. The market size of our country's photoresist is

expected to reach 10.92 billion yuan in 2023, increase to 11.44 billion yuan in

2024, and is expected to exceed 12.3 billion yuan in 2025. This growth is not

only due to the capacity expansion of downstream fabs, but also due to

technological breakthroughs and import substitution by local companies in the

field of low-end photoresists.

(2) Competitive landscape: local

opportunities under international leadership

The photoresist market presents a highly

monopolistic pattern, with international companies such as JSR, Tokyo Yinghua,

Shin-Etsu, DuPont, Fuji and other international companies occupying a major

share of the global market with decades of technology accumulation, especially

in the field of semiconductor photoresists, almost monopolizing the supply of

high-end products. At present, our country enterprises are mainly concentrated

in the low-end market such as PCB photoresist, Jingrui Electric Materials, Nanda

Optoelectronics, Shanghai Xinyang and other enterprises are gradually

penetrating into the semiconductor photoresist field through R&D

investment, among which Nanda Optoelectronics' ArF photoresist has passed

customer verification, achieving zero breakthrough in the high-end field of

domestic photoresist.

3. Electronic special energy: the

"invisible cornerstone" of chip manufacturing

(1) Market size: a stable engine for

demand growth

Electronic special gas is an indispensable

key material in chip manufacturing, widely used in ion implantation, etching,

deposition and other processes. In 2023, our country's electronic special gas

market size has reached 24.9 billion yuan, which is expected to increase to

26.25 billion yuan in 2024 and exceed 27.9 billion yuan in 2025. This steady

growth trend is mainly due to the continuous expansion of integrated circuits,

display panels and other industries, especially in the production of advanced

process chips, the demand for high-purity electronic special gas is growing at

a faster rate.

(2) Market pattern: the rise of the

local market under the leadership of foreign capital

our country's electronic special gas market

has been monopolized by international giants for a long time, with Air Chemical

ranking first with a market share of 25%, followed by Linde Group, Air Liquide,

and Taiyori Acid, accounting for a total of 61% of the market share. In recent

years, local enterprises such as Jinhong Gas, Walter Gas, and Nanda

Optoelectronics have achieved the localization of some high-end electronic

special gases through technical research, such as Walter Gas' photoresist gas

products have passed ASML certification, breaking the supply monopoly of

foreign companies and gradually occupying a place in the market.

4. Packaging Materials: The "Last

Barrier" to Chip Performance

(1) Packaging substrate: the core

carrier of high-density connection

As a "bridge" between chips and

PCBs, packaging substrates are much more difficult to process and have higher

investment thresholds than ordinary PCB products, making them one of the most

technologically advanced fields in packaging materials. Benefiting from the

promotion of domestic substitution strategies, our country's packaging

substrate market size will reach 20.7 billion yuan in 2023, a year-on-year

increase of 2.99%, and is expected to increase to 21.3 billion yuan in 2024 and

22 billion yuan in 2025. The packaging substrate not only undertakes the power

supply connection and protective support functions of the chip, but also plays

a key role in reducing the package size, improving heat dissipation

performance, and achieving high-density integration, and is the core support

material for advanced packaging technology. Local enterprises such as Shennan

Circuit and Xingsen Technology have achieved breakthroughs in the field of

packaging substrates, and their product performance is gradually approaching the

international level.

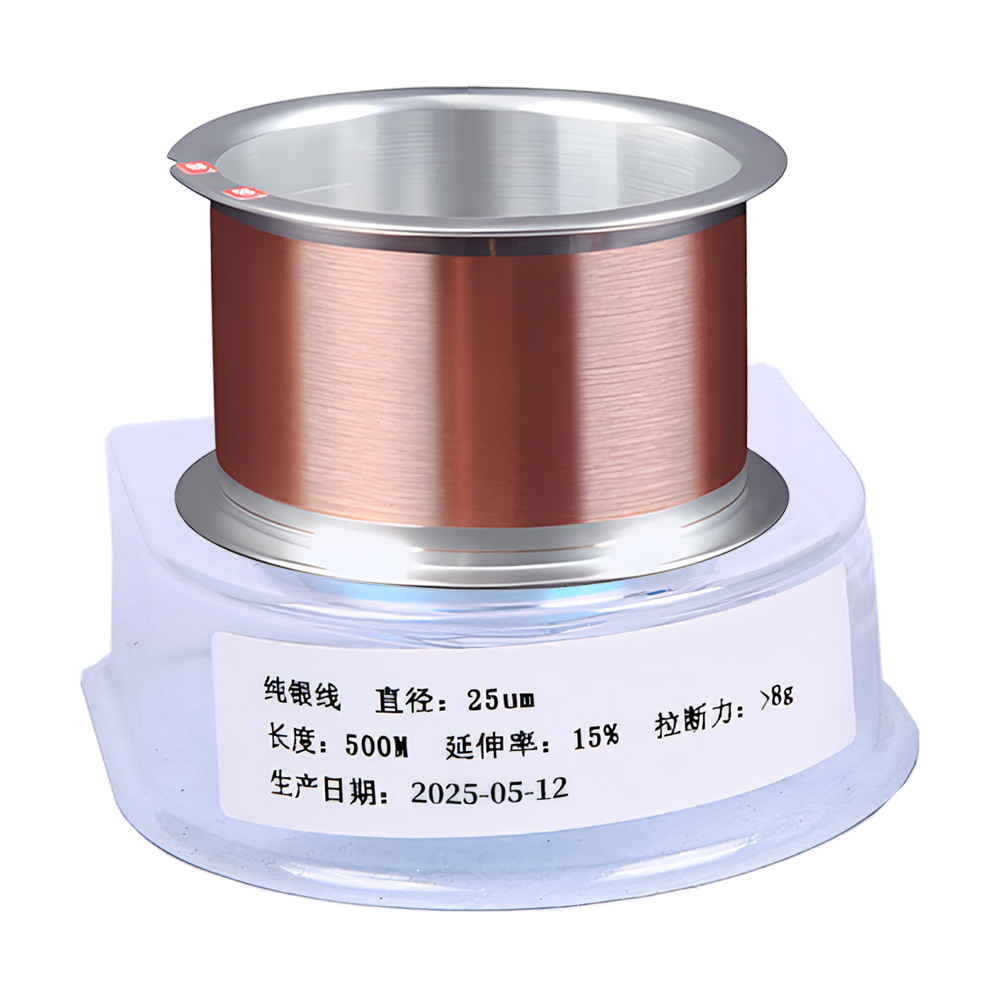

(2) Bonding wire: the "conductive

nerve" inside the chip

The bonding wire is a tiny metal wire that

connects the internal circuit of the chip with the lead frame, with a diameter

of only ten to tens of microns, which can be called the "capillaries"

of the chip. According to the material, it can be divided into non-alloy wire

(gold wire, silver wire, copper wire, aluminum wire) and alloy wire

(gold-plated silver wire, copper-plated bonding wire, etc.). In this field,

international companies such as Heraeus and Japan's Tanaka Precious Metals

occupy a dominant position, but local companies such as Yantai Yinuo Electronic

Materials have achieved batch substitution in the field of low-end products

such as copper wire and aluminum wire through technological innovation,

gradually breaking the international monopoly.

(3) Lead frame: the "skeleton

support" of the chip

As the carrier of the chip, the lead frame

undertakes the dual functions of signal transmission and mechanical support,

and the world's major manufacturers are concentrated in Asia. The Dutch Baishi

Electronics Group is the only leading enterprise in Europe, and Ningbo

Kangqiang Electronics, Ningbo Hualong Electronics and other enterprises in our

country have formed large-scale production capacity in the field of lead frames

through years of development, and their products are widely used in consumer

electronics, automotive electronics and other fields, becoming an important

player in the global supply chain.

5. Etching machines: the "precision

engraving knife" of chip manufacturing

(1) Market size: technology iteration

drives growth

Etching machines are one of the core

equipment in semiconductor manufacturing, and their precision requirements

continue to improve in the process of breaking through the chip process from

micron to nanometer. The global etching machine market size reached USD 14.82

billion in 2023, a year-on-year increase of 5.93%, and is expected to increase

to USD 15.65 billion in 2024 and USD 16.48 billion by 2025. This growth is

mainly due to the expansion of advanced process chip production capacity and

the proliferation of new storage technologies such as 3D NAND, which has led to

an increase in the demand for etching steps and equipment.

(2) Enterprise competition:

international monopoly and local breakthrough

The global etching machine market is highly

concentrated, with the three international giants LAM Research, AMAT, and TEL

occupying the vast majority of the market share with their technical advantages

and complete product lines. Through independent research and development, our

country's enterprises China Micro Company and North Huachuang have achieved

breakthroughs in the fields of dielectric etching and silicon etching, and the

5nm etching machine of China Micro Company has entered TSMC's supply chain and

has become one of the few enterprises in the world that can provide advanced

process etching equipment, marking our country's major progress in the field of

high-end semiconductor equipment.

3. Midstream analysis: the

"innovation battlefield" of GPU chips

1. Global Market: AI-driven scale

expansion

With the explosive growth of artificial

intelligence, supercomputing and other technologies, the market demand for

GPUs, as the core hardware of parallel computing, has increased exponentially.

The global GPU market size reached $59.5 billion in 2023, is expected to

increase to $71.9 billion in 2024, and will exceed $80 billion by 2025. This

growth not only comes from the traditional PC and mobile device fields, but

also from the explosion of demand for emerging scenarios such as data center AI

training and autonomous driving, and NVIDIA's H100, A100 and other data center

GPUs have become "hits" in the market, driving the rapid expansion of

the industry.

2. Chinese market: Local substitution is

accelerating

our country's GPU market is in a period of

rapid growth, with a market size of 80.7 billion yuan in 2023, a year-on-year

increase of 32.78%, and is expected to exceed 107.3 billion yuan in 2024 and

increase to 120 billion yuan in 2025. This growth rate far exceeds the global

average, mainly due to the vigorous development of the domestic AI industry and

the drive of independent and controllable demand. Although the high-end market

is still dominated by international giants, local companies such as Biren Technology,

Muxi Integrated Circuit, and Moore Thread have launched a number of

self-developed GPU products and emerged in the wave of domestic substitution.

3. Competitive landscape: international

giants dominate and local breakthroughs

In the independent GPU market, NVIDIA

occupies 81% of the market share with its strong computing power performance

and CUDA ecosystem, forming an absolute leading position; AMD came in second

with a 19% share, mainly in the gaming and data center segments. Although our

country's local companies started late, they have achieved breakthroughs in

specific scenarios, such as Biren Technology's BR100 GPU is close to the

international advanced level in computing power indicators, and Muxi Integrated

Circuit's MX1 series products perform well in AI inference scenarios.

4. Enterprise layout: The regional

agglomeration effect is significant

From the perspective of the distribution of

A-share listed companies, our country's GPU enterprises show obvious regional agglomeration

characteristics. Guangdong Province ranks first with 14 listed companies,

relying on the perfect electronic information industry ecology in the Pearl

River Delta, forming a complete chain from chip design to terminal application;

Beijing and Jiangsu provinces each have 8 listed companies, which have become

important agglomeration areas for the GPU industry with their innovative

resources in Zhongguancun and the manufacturing foundation of the Yangtze River

Delta. This regional agglomeration effect is conducive to technical cooperation

and resource sharing among enterprises, and accelerates the pace of industrial

innovation.

4. Downstream analysis: the

"application blue ocean" of computing power demand

1. Data center: the core support of

computing power infrastructure

our country basic telecom operators

continue to increase the construction of computing power infrastructure, and by

the end of 2024, the number of Internet data center racks open to the public

has reached 830,000. This large-scale infrastructure network not only improves

the collaborative scheduling capabilities of computing power and network, but

also provides solid hardware support for AI training, cloud computing and other

scenarios, becoming one of the largest application markets for GPU chips. With

the advancement of the "East Data and West Computing" project, the

computing power demand of data centers will be further released, driving the

continuous growth of the GPU market.

2. AI Computing Power: The core engine

of explosive growth

In 2024, our country's total intelligent

computing power will reach 725.3 trillion times per second (EFLOPS), a

year-on-year increase of 74.1%, more than three times the increase in general

computing power (20.6%) in the same period, and is expected to jump to 1037.3

EFLOPS in 2025. This explosive growth is mainly due to the rapid iteration of

large language models, generative AI and other technologies, and the demand for

GPU computing power has increased exponentially, and NVIDIA's GPU products have

become the "standard" for AI training, while also providing a broad

alternative space for domestic GPUs.

3. Cloud computing: GPU-enabled service

upgrades

our country's cloud computing market has

maintained rapid growth, with a scale of more than 616.5 billion yuan in 2023,

a year-on-year surge of 35.5%, far exceeding the global average, and is

expected to reach 837.8 billion yuan in 2024. With the popularization of AI

native technology and the implementation of large model applications, cloud

computing is transforming from traditional computing power rental to

intelligent services, and the demand for GPUs, as the core hardware of cloud

intelligent computing, continues to rise. It is expected that by 2027, our

country's cloud computing market will exceed 2.1 trillion yuan, and the

penetration rate of GPUs in it will further increase, becoming a key driving

force for industry growth.

Overall, China's GPU industry chain in 2025

is in a critical development period of "coexistence of opportunities and

challenges". the localization rate of upstream materials and equipment has

gradually increased, but the high-end field still relies on imports; Midstream

chip design companies have accelerated their catch-up and achieved

breakthroughs in specific scenarios, but ecological construction has lagged

behind. The downstream application market demand is strong, providing strong

impetus for industrial development. With the continuous increase in policy

support and the increase in enterprise R&D investment, our country's GPU

industry chain is expected to occupy a more important position in global

competition and inject core computing power into the development of the digital

economy.

Su Gongwang Security 32058302004438

Su Gongwang Security 32058302004438